Prediction: Taiwan Semiconductor Will Be a Trillion-Dollar Company by 2025

Few companies are as important to today’s world as Taiwan Semiconductor Manufacturing (NYSE: TSM). It produces the chips that go into devices that power artificial intelligence (AI) models, iPhones, and nearly any other application with a microchip. Taiwan Semiconductor is a leading business in this field, but it’s not done growing.

Currently, Taiwan Semiconductor is valued at $845 billion, making it the ninth-largest company in the world. However, by the time 2025 comes around, it could easily cross the $1 trillion point in value.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,688!*

Taiwan Semiconductor is a class-leading chip foundry

Part of Taiwan Semiconductor’s success is its position in the chip market. As a foundry that sells its capabilities and manufacturing prowess to businesses that need chips, it doesn’t have to worry about marketing its products; it leaves that to its customers. In many cases, Taiwan Semiconductor produces chips for companies that are competing against each other, like Nvidia and Advanced Micro Devices.

But these competitors go to the same place because of Taiwan Semiconductor’s leading technology. Right now, TSMC boasts industry-leading 3 nanometer (nm) technology. This measurement describes the distance between conductive paths, and 3nm is incredibly small. For reference, a human hair is between 80,000 and 100,000 nanometers wide. The smaller the distance between these traces, the more transistors a client can pack onto the chips. This allows customers to configure their chip to be more efficient, powerful, or a combination of both.

But Taiwan Semiconductor isn’t stopping there. It’s already working on its 2nm node, which is expected to launch in 2025. Management stated that the demand for its 2nm chip is greater than its 3nm or 5nm at this stage in development, which is fantastic news for shareholders.

Taiwan Semiconductor is already at the top of the chip world with its innovative technology, and investors should be excited to invest in its culture of continuous improvement.

But what will it take for Taiwan Semiconductor to become a $1 trillion company?

Taiwan Semiconductor’s road to a $1 trillion valuation is clear

In Q1, TSMC’s revenue increased by 13% year over year in U.S. dollars, but Q2 revenue is expected to grow by 27%. This revenue acceleration is key in Taiwan Semiconductor’s growth trajectory, as 2023 wasn’t its best year.

Wall Street analysts expect strong growth throughout this year and next, with revenue increasing 23% in 2024 and 22% in 2025. With the average analyst projecting $103.3 billion in revenue by the end of 2025, Taiwan Semiconductor emerged as one of the most dominant companies in the world.

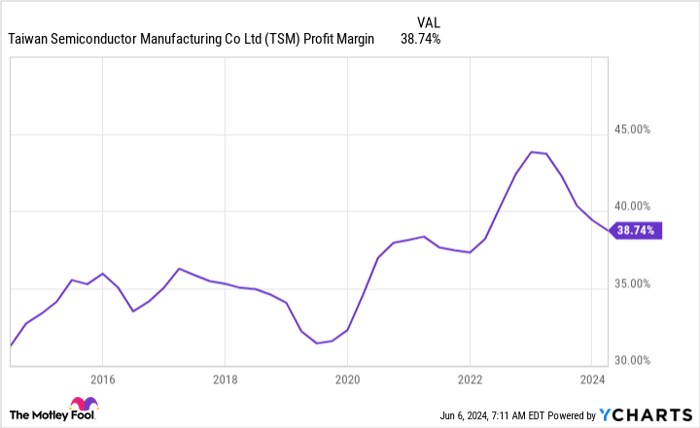

While profit margins can fluctuate significantly in the chip industry (due to it being cyclical), Taiwan Semiconductor steadily produced strong profit margins.

Even if you pencil in a slight profitability decrease to a 35% profit margin by the end of 2025, Taiwan Semiconductor would be producing $36.2 billion in profits.

If you divide the target market cap of $1 trillion by the estimated 2025 profits, you get Taiwan Semiconductor’s price-to-earnings (P/E) ratio. This would yield a P/E of 27.6, which isn’t cheap. However, that P/E is in line with what investors have seen over the past five years and cheaper than where it is today.

As a result, if Taiwan Semiconductor hits the target that analysts think it can, it should easily be a $1 trillion company by the end of 2025. However, I think that would just be the beginning for a juggernaut like Taiwan Semiconductor, as its chips are widely used in the industry.

Because of that, I think Taiwan Semiconductor is an excellent stock to buy now, as its culture of continuous improvement will create a demand for new chips every couple of years.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,688!*

What You Need to Know About Taiwan and Semiconductors

In 2020, COVID hit the global economy like a ton of bricks. Lockdowns induced a global slowdown and disrupted supply chains. Not only toilet paper but also semiconductors were in short supply.

A 2021 commentary by the Boston Consulting Group (BCG) tells us that the US is the leader in research and development. Thanks to its top-class universities, fantastic talent pool, vast capital, innovative culture and extraordinary ecosystem, the US dominates “electronic design automation (EDA), core intellectual property (IP), chip design, and advanced manufacturing equipment.”

When it comes to manufacturing, which is referred to as fabrication in the industry, East Asia is top dog. Gone are the days of Fairchild when a group of eight brilliant engineers could walk off to launch the modern semiconductor industry in Silicon Valley. Now, manufacturing semiconductors needs massive capital investments. New foundries can “cost between $10-$20 billion and can take three to five years to build.”

To run such a capital-intensive industry, government backing helps. So does robust infrastructure and a skilled workforce. BCG rightly tells us that East Asia has all these ingredients to make its semiconductor industry thrive. China, South Korea, Japan and Taiwan have followed strong industrial policies, backing the semiconductor industry as a national priority. The US, where this industry began, now makes a mere 12% of the world’s semiconductors.

Taiwan’s Extraordinary Success in Semiconductors

In assembly, packaging and testing, China leads because of its cost advantage. Its neighbors make more advanced stuff. As per BCG, “all of the world’s most advanced semiconductor manufacturing capacity—in nodes below 10 nanometers—is currently located in South Korea (8%) and Taiwan (92%).” According to some, Taiwan is the Mecca of the semiconductor industry.

The biggest success story in the country is Taiwan Semiconductor Manufacturing Company (TSMC). It is the largest contract chipmaker in the world. In 2021, Kathrin Hille of The Financial Times reported about a TSMC plant that would make 3 nanometer semiconductor chips, which would be 70% faster and more power efficient than the most advanced in production at the time. TSMC has a history of making big investments that take a while to generate returns. In 2021, it budgeted $25-28 billion for capital investment. Competitors in the US have struggled to keep up because Wall Street forces them to focus on quarterly earnings and, until the 2022 CHIPS Act, the government offered few goodies.

TSMC has also invested wisely. It has plowed money into developing cutting-edge technology. The company has constructed giant fabrication plants, known as “fabs.” Hille’s 2021 reportage described a fab that measured 160,000 square meters, the equivalent of 22 football (soccer) fields. TSMC has not only focused on economy of scale but also efficiency of operations. The company achieves 95% yield in its factories. This means that 19 out of the 20 chips it makes are perfect.

The success of TSMC and other Taiwanese semiconductor companies owes a great deal to the national culture. Taiwan’s rigorous education system churns out high-quality electrical engineers and excellent technicians. The proverbial East Asian work ethic also helps. Employees work extraordinarily hard to maintain high production standards.

So far, location has helped too. Since Deng Xiaoping’s 1978 economic reforms, China has grown spectacularly. After joining the World Trade Organization in 2001, the Middle Kingdom has become the factory of the world. It is the largest manufacturer of electronics. As China’s next door neighbor, Taiwan’s location made the country an ideal location for semiconductor manufacturing and a strategic hub for the industry.

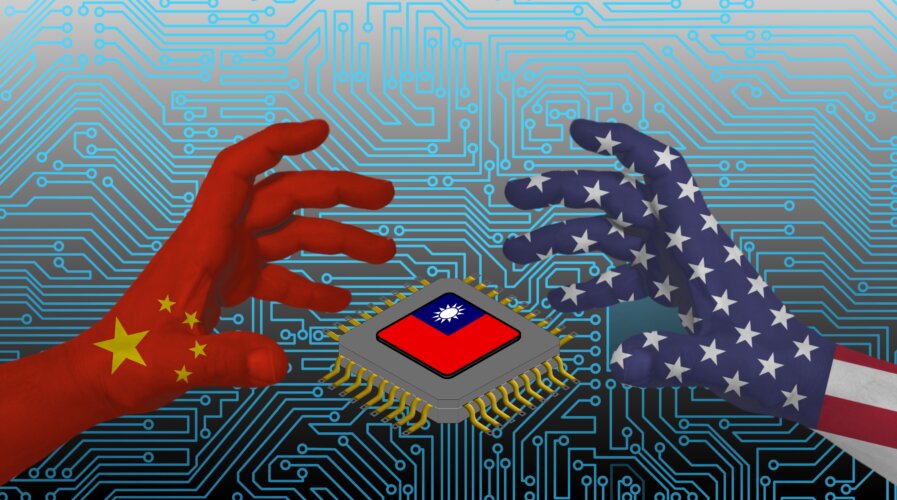

Geopolitical Typhoons Threaten Taiwan

Taiwan’s location and success are both a blessing and a curse. As mentioned above, location played a part in Taiwanese success. It has played a part in making the country integral to the semiconductor global supply chain. This global reliance on Taiwan might compel the US to support this breakaway island more robustly against China. Yet this threat comes precisely because Taiwan is next door to China and the legacy of a civil war that began in the 1930s divides the two.

In 1949, the Chinese Communist Party (CCP) emerged triumphant. Its rival, the Kuomintang (KMT), fled Mainland China and took refuge in Taiwan, which they named as the Republic of China (ROC). The CCP-led People’s Republic of China (PRC) believes in the One-China principle and seeks eventual “unification” with ROC. In Beijing’s eyes, Taiwan is a renegade province that must return to the fold just as Hong Kong.

Increasingly, the Taiwanese do not find reunification a palatable idea. The 1992 Consensus that kept tempers under control is now fraying. This agreement allowed the CCP and KMT to kick into the long grass the tricky question of which of their two governments was the legitimate, exclusive representative of “China.” Instead, both of them focused on more immediate practical matters.

Unlike China, Taiwan is a rambunctious democracy of 23 million people. In 2016, President Tsai Ing-wen, led her Democratic Progressive Party (DPP) to victory. She has refused to endorse the 1992 Consensus. This has caused great offense to President Xi Jinping who has brought back a Mao-style personality cult to China. Under him, China has become ultranationalist and hyper-aggressive. In recent years, Beijing’s “wolf warrior” diplomacy has unleashed a torrent of online abuse, misinformation and disinformation. The temperature in the Taiwan Strait has been rising.

Top analysts in the US have been worrying about the superpower’s reliance on Taiwan. They argue this semiconductor superpower is a single point of failure. Therefore, the US must develop its semiconductor industry again. President Joe Biden and the Congress have taken note. As referred to earlier, the CHIPS Act was enacted last year. In the words of the White House, this legislation will “lower costs, create jobs, strengthen supply chains, and counter China.”

It is not only the US that is spending tens of billions of dollars on semiconductor production. The EU is also getting into the act. Japan and South Korea are investing as well. The 800-pound gorilla in the room is China. Beijing is putting in hundreds of billions of dollars to move up the semiconductor industry value chain—make complex high-value chips, not just simpler low-value ones. Such massive investments by competitor nations could threaten Taiwan’s current top dog status in the semiconductor industry.

There is another wrinkle for Taiwanese industry. The US has instituted a series of measures to choke off China’s access to cutting-edge semiconductor chips, technology and manufacturing equipment. Historians have drawn parallels between this measure to the US 1939-41 sanctions on Japan. As per Niall Ferguson, these “sanctions so boxed in the imperial government that in the end there seemed no better option than to gamble on surprise attack.” Cutting off China from semiconductor capability “is a lot like cutting Japan off from oil in 1941.” Beijing’s incentives to attack its island neighbor for its semiconductor fab plants have just increased and so have Taiwan’s headaches. source

Tech History

Tech History

Cops Gone Wild

Cops Gone Wild