FTX’s Samuel Bankman Fried Made illegal Campaign Contributions

- Federal authorities charged FTX founder Sam Bankman-Fried with using tens of millions of dollars of misappropriated customer funds to make illegal political donations to both Democratic and Republican candidates.

- Prosecutors said one of the reasons he made those contributions was to influence the direction of policies and laws affecting the cryptocurrency industry.

- He diverted customer assets held by cryptocurrency exchange FTX to his crypto hedge fund, Alameda Research, the Securities and Exchange Commission charged in a civil complaint.

- A private ethics watchdog last week asked the Federal Election Commission to investigate Bankman-Fried for his alleged admissions of donating dark money to groups linked to Republicans.

-

Indictment alleges FTX head ran straw man donor scheme

-

FTX’s big three political donors gave $76 million since 2020

-

Sam Bankman-Fried ran FTX as a fraud ‘from the start,’ SEC charges

-

FTX spent $256 million on Bahamas real estate — now the island’s government wants it back

-

FTX spokesman Kevin O’Leary says he lost his $15 million payday from crypto firm

-

Former FTX CEO Sam Bankman-Fried refuses to testify before Senate, committee says

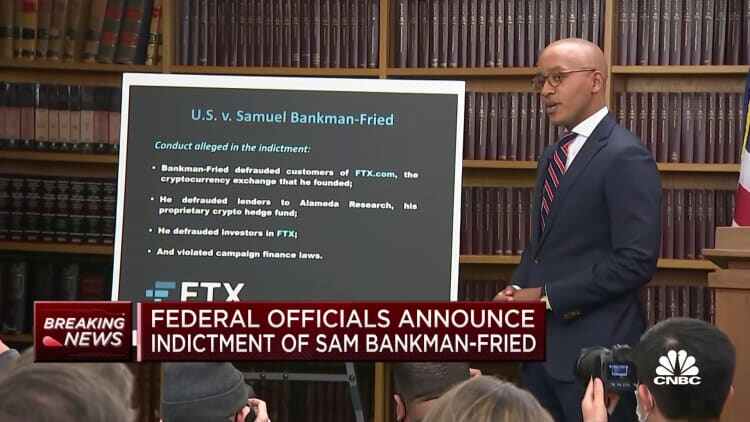

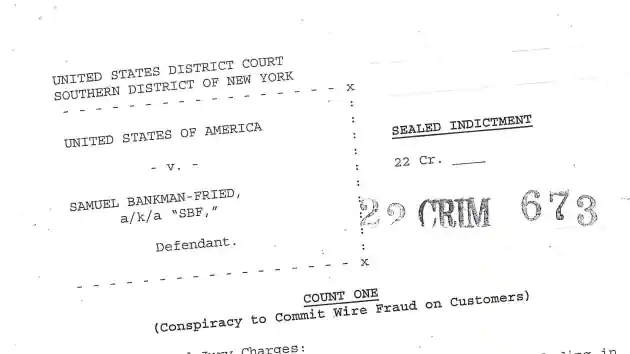

NEW YORK (AP) — The U.S. government charged Samuel Bankman-Fried, the founder and former CEO of cryptocurrency exchange FTX, with a host of financial crimes on Tuesday, alleging he intentionally deceived customers and investors to enrich himself and others, while playing a central role in the company’s multibillion-dollar collapse.

Bankman-Fried has fallen hard and fast from the top of the cryptocurrency industry he helped to evangelize. FTX filed for bankruptcy on Nov. 11, when it ran out of money after the cryptocurrency equivalent of a bank run.

Before the bankruptcy, he was considered by many in Washington and on Wall Street as a wunderkind of digital currencies, someone who could help take them mainstream, in part by working with policymakers to bring more oversight and trust to the industry.

He was worth tens of billions of dollars — at least on paper — and was able to attract celebrities like Tom Brady or former politicians like Tony Blair and Bill Clinton to his conferences at luxury resorts in the Bahamas. He was the subject of fawning profiles in media, was considered a prominent advocate for a type of charitable giving known as “effective altruism,” and commanded millions of followers on Twitter.

But since FTX’s implosion, Bankman-Fried and his company have been likened to other disgraced financiers and companies, such as Bernie Madoff and Enron.

The criminal indictment against Bankman-Fried and “others” at FTX is on top of civil charges announced Tuesday by the Securities and Exchange Commission and the Commodity Futures Trading Commission. The SEC alleges Bankman-Fried defrauded investors and illegally used their money to buy real estate on behalf of himself and his family.

U.S. authorities said they will try to claw back any of Bankman-Fried’s financial gains from the alleged scheme.

A lawyer for Bankman-Fried, Mark S. Cohen, said Tuesday he is “reviewing the charges with his legal team and considering all of his legal options.”

At a congressional hearing Tuesday that was scheduled before Bankman-Fried’s arrest, the new CEO brought in to steer FTX through its bankruptcy proceedings leveled harsh criticism. He said there was scant oversight of customers’ money and “very few rules” about how their funds could be used.

John Ray III told members of the House Financial Services Committee that the collapse of FTX, resulting in the loss of more than $7 billion, was the culmination of months, or even years, of bad decisions and poor financial controls.

“This is not something that happened overnight or in a context of a week,” he said.

He added: “This is just plain, old-fashioned embezzlement, taking money from others and using it for your own purposes.”

Before his arrest, Bankman-Fried had been holed up in his luxury compound in the Bahamas. U.S. authorities are expected to request his extradition to the U.S., although the timing of that request is unclear.

Prosecutors said one of the reasons he made those contributions was to influence the direction of policies and laws affecting the cryptocurrency industry.

Bankman-Fried diverted customer assets held by FTX, a major cryptocurrency exchange,

to his separate crypto hedge fund, Alameda Research,

the Securities and Exchange Commission charged in a civil complaint filed in Manhattan federal court.

Federal authorities on Tuesday charged FTX co-founder Sam Bankman-Fried with using what they said was tens of millions of dollars of misappropriated customer funds to make illegal political donations to both Democratic and Republican candidates.

Prosecutors said one of the reasons he made those contributions was to influence the direction of policies and laws affecting the cryptocurrency industry.

Most of Bankman-Fried’s publicly disclosed campaign contributions, which totaled nearly $40 million in the 2022 election cycle, went toward Democrats, FEC records show.

But FTX donated $1 million to the Senate Leadership Fund, a super PAC aligned with Republican Senate Minority Leader Mitch McConnell of Kentucky.

Bankman-Fried diverted customer assets held by FTX, a major cryptocurrency exchange, to his separate crypto hedge fund, Alameda Research, the Securities and Exchange Commission charged in a civil complaint filed in Manhattan federal court.

He then used those funds to make “large political donations,” to make investments and buy “lavish real estate,” the SEC complaint alleged.

Bankman-Fried “used Alameda as his personal piggy bank” for those purposes, the SEC said. Damian Williams, the U.S. attorney for Southern New York, said at a news conference unveiling the eight-count criminal indictment, which included a campaign finance violation charge.

At a press conference on Tuesday, U.S. Attorney Damian Williams called it “one of the biggest frauds in American history,” and said the investigation is ongoing and fast-moving. He urged anyone who believes they have been victims of the scheme to contact his office.

The donations, Williams said, were “disguised” to look as though they were coming from wealthy donors when, in fact, the contributions were funded by Bankman-Fried’s privately held crypto hedge fund, Alameda Research, using stolen customer money.

“And all of this dirty money,” Williams said, was used to “buy bipartisan influence and impact the direction of public policy in Washington.”

Mark S. Cohen, Bankman-Fried’s attorney, said his client “is reviewing the charges with his legal team and considering all of his legal options.”

Bankman-Fried spent at least $70 million on 2022 campaigns, according to Federal Election Commission records — and three sources have told NBC News that there was much more in “dark money,” a term used to describe legal donations that do not have to be publicly disclosed — to engender goodwill with candidates on both sides of the aisle and to be in a position to peddle influence around the crypto industry no matter the outcome of the election.

Federal law limits donations from an individual to a single candidate to $5,800 — $2,900 for the general election and an equal amount for the primary.

Prosecutors alleged in the indictment Tuesday that Bankman-Fried deceived the FEC by making “contributions to candidates for federal office, joint fundraising committees and independent expenditure committees in the names of other persons” beginning in 2020 and continuing until last month.

The indictment alleges he also made illegal contributions through a corporation, which it does not name.

Prosecutors contended Tuesday that Bankman-Fried’s Alameda Research was the source of funds.

Bankman-Fried, 30, hosted conferences in the Bahamas that boasted visits from former politicians like Tony Blair and Bill Clinton, The Associated Press reported, as he built a reputation as a heavyweight campaign contributor — particularly among Democrats, whom he publicly courted in recent years.

Once believed to be a financial wunderkind, Bankman-Fried also faces a host of other charges. Prosecutors allege he committed wire fraud against customers and lenders and concocted conspiracies to commit money laundering and commodities and securities fraud, according to the indictment.

A separate civil complaint released Tuesday provided further details about how Bankman-Fried is alleged to have continued to expand a web of financial deceit to create a nearly limitless piggy bank that he used to buy luxury condos and real estate for himself, relatives and friends, as well as to donate millions to political campaigns.

He raised at least $1.8 billion for various FTX stock classes across numerous fundraising rounds, court documents show. About $1.1 billion was raised from just 90 U.S. investors.

Prosecutors allege in the civil complaint that Bankman-Fried improperly diverted huge sums to Alameda, which allowed him to use the money for his own purposes — even to provide himself loans.

However, he never disclosed the close relationship FTX had with Alameda to his investors, nor did he disclose Alameda’s “virtually unlimited ‘line of credit’ at FTX, its ability to carry a negative balance in its FTX customer account, and its exemption from FTX’s automated liquidation process,” according to the civil complaint.

Bankman was arrested in the Bahamas on Monday following his indictment by a federal grand jury in the Southern District of New York on Friday, Williams told reporters.

“This investigation is very much ongoing, and it is moving very quickly,” Williams said. “While this is our first public announcement, it will not be our last.”

A separate but related federal criminal indictment accuses Bankman-Fried and others of violating numerous federal campaign finance laws by, among other things, giving contributions of at least $25,000 to campaigns and political action committees “in the names of other persons.”

“All this dirty money was used in service of Bankman-Fried’s desire to buy bipartisan influence and impact the direction of public policy,” said Damian Williams, the U.S. Attorney for the Southern District of New York, at a press conference.

If convicted of all the charges against him, Bankman-Fried could face decades in jail, according to Nicholas Biase, a spokesperson for U.S. prosecutors.

The scheme also allegedly “was in service of the defendant’s desire to influence the direction of policy and legislation on the cryptocurrency industry,” the prosecutor wrote.

His attorney Mark Cohen, in a statement, said, “Mr. Bankman-Fried is reviewing the charges with his legal team and considering all of his legal options.”

Howard Fischer, a former Securities and Exchange Commission lawyer, told CNBC, “Given the speed of the government complaints and the indictment, it seems likely that former FTX employees (most likely those in senior positions) were cooperating with the authorities, most likely in exchange for leniency.”

“With a large case like this, there is often a rush to be the first one in the prosecutor’s door, because the value of cooperation diminishes rapidly if all you can offer is a duplicate of what the authorities already have,” said Fischer, a partner with the law firm Moses & Singer.

Fischer, referring to former Alameda CEO Caroline Ellison, said, “While it is not known yet if that is the case, or who might be cooperating at this point, I would not be surprised if Ms. Ellison was one of the first person’s seeking to help the prosecution.”

He noted that Ellison’s own lawyer is the former co-head of SEC’s Division of Enforcement, and she knows how the system works and how to work it to her client’s advantage.”

Ellison’s attorney was not immediately available to comment.

This article was contributed by many people NBCNews.com Story by Phil McCausland and Alex Seitz-Wald and Brian Schwartz@SCHWARTZBCNBC Dan Mangan@_DANMANGAN

including Associated Press Writer Fatima Hussein in Washington contributed to this report. and PBS

12.14.2022 This TOP STORY has been updated since it initial posting