Josh Hawley introduces PELOSI Act to bar lawmakers from trading stocks and profiting while in office

Sen. Josh Hawley introduced the PELOSI Act on Tuesday, following a previous bill he introduced barring members from trading stocks

A Republican in the U.S. Senate is looking to prevent lawmakers and their spouses from trading stocks on which the officials would have privileged information and used the bill’s title to make a not-so-subtle dig at former House Speaker Nancy Pelosi.

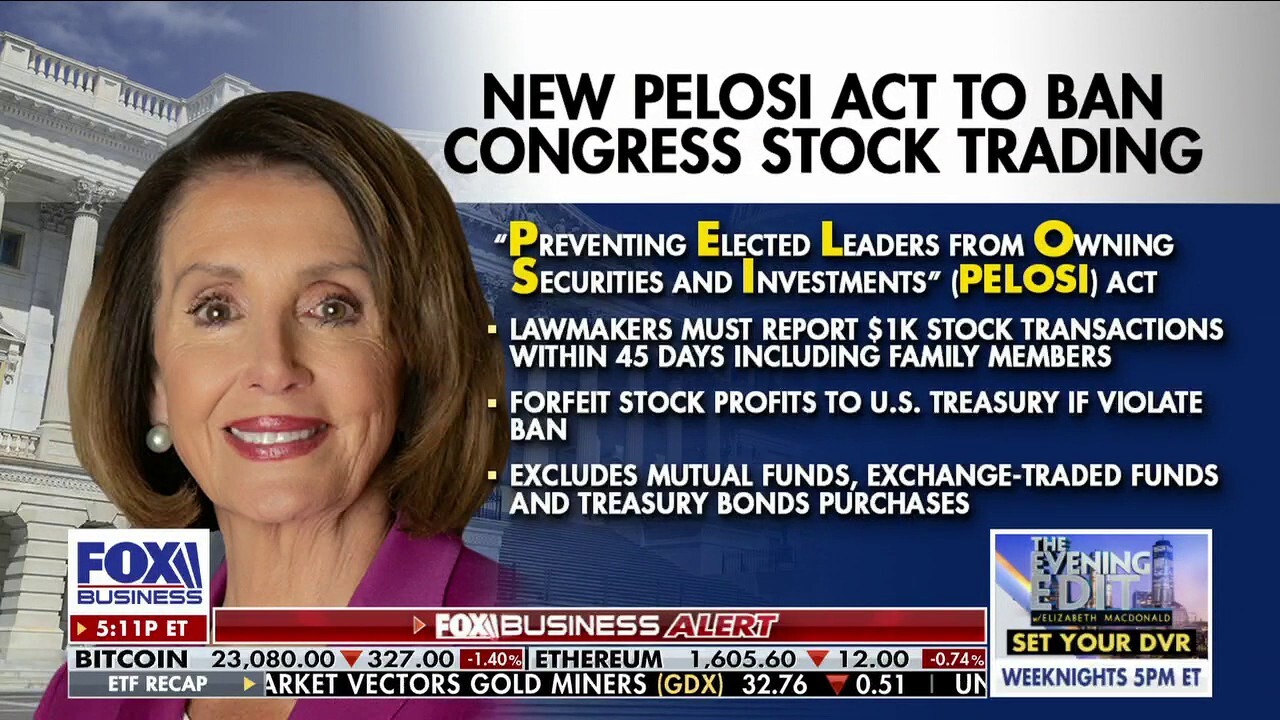

On Tuesday, Sen. Josh Hawley, R-Mo., introduced the PELOSI Act, officially the Preventing Elected Leaders from Owning Securities and Investments Act, requiring members and their spouses to divest any holdings or put them in a blind trust within six months of entering office.

“Members of Congress and their spouses shouldn’t be using their position to get rich on the stock market – today l’m introducing legislation to BAN stock trading & ownership by members of Congress. I call it the PELOSI Act,” he wrote Tuesday on Twitter.

The bill comes after revelations last year that Nancy’s husband, Paul Pelosi, traded between $1 million and $5 million of stocks for semiconductors just days before Congress allocated $52 million to the industry. The stocks were later sold at a loss to remove the appearance of impropriety.

Other lawmakers and their spouses have made similarly advantageous trades, including Sen. Richard Burr, R-N.C., who sold investments after receiving classified briefings on the coronavirus pandemic.

Hawley’s bill excludes mutual funds, exchange-traded funds and Treasury bonds purchases.

Hawley’s bill would require any profits made by a lawmaker to be returned to American taxpayers.

It also specifically amends the Ethics in Government Act of 1978, which prohibits using nonpublic information for private profit, commonly known as insider trading — which is already illegal for business leaders and everyday Americans.

The bill currently requires the President of the United States, the vice president, specific executive branch employees, the Postmaster General, some civilian employees, certain members of Congress and judicial officers to file a report that includes the source, type and value of income gained from any source other than their current employment.

The legislation, which was signed into law, prohibits lawmakers and employees from utilizing information gained through legislative meetings to profit privately. The act also says lawmakers are not exempt from insider trading prohibitions under securities laws.

It requires congressional lawmakers to report any stock transactions by themselves or their family members of $1,000 or more within 45 days.

The push to prevent lawmakers from privately profiting through their public office has bipartisan support, and Hawley and others on both sides of the proverbial aisle have initiated legislative action to outlaw such action.

Earlier this year, Hawley introduced a bill that would ban lawmakers from making stock trades while in office. Sens. Jon Ossoff, D-Ga., and Mark Kelly, D-Ariz., introduced similar legislation.

Earlier this month, Reps. Chip Roy, R-Texas, and Abigail Spanberger, D-Va., reintroduced a bill that would ban lawmakers and their family members from trading individual stocks or using their public office for “political gain.”

The TRUST Act, formally known as the Transparent Representation Upholding Service and Trust in Congress Act, would require lawmakers and family members to transfer specific investments into a qualified blind trust while serving in Washington.

“Strengthening our democracy and building true resilience against corruption is not just about preventing unethical decisions, but it is also about addressing the feeling among many Americans that their elected officials and government don’t work for them. This perception is damaging to our democracy, and the TRUST in Congress Act would help build trust and assure the public that members of Congress are not serving their own financial interests,” Spanberger said at the time.Original cosponsors of the bill include Reps Scott Perry, R-Pa.; Matt Gaetz, R-Fla.; Jerry Nadler, D-N.Y.; Adam Schiff, D-Calif.; Dusty Johnson, R-S.D.; Nikema Williams, D-Ga.; Dean Phillips, D-Minn.; Chellie Pingree, D-Maine; Angie Craig, D-Minn.; Mary Gay Scanlon, D-Pa.; Brian Fitzpatrick, R-Pa.; Pete Sessions, R-Texas; Grace Meng, D-N.Y.; and Joe Courtney, D-Conn.

Josh Hawley needles Nancy Pelosi by renaming his congressional stock trading ban bill after her

- Sen. Josh Hawley is trying to taunt Nancy Pelosi by renaming a stock trading ban bill.

- His PELOSI Act is a retread of a proposal that garnered no support in the last Congress.

- House lawmakers recently reintroduced a bipartisan stock trading proposal with broader backing.

Sen. Josh Hawley took a parting shot at former Speaker Nancy Pelosi by slapping her name on a languishing congressional stock trading ban proposal that would stifle her husband’s livelihood.

The Preventing Elected Leaders from Owning Securities and Investments (PELOSI) Act is a performative rewrite of the bill Hawley floated in the 117th Congress which failed to get a single cosponser. The only major change to the bill this session is it has been tweaked to specifically ding the California Democrat since she stepped down from her leadership role.

“Members of Congress and their spouses shouldn’t be using their position to get rich on the stock market,” Hawley wrote online, taking an obvious swipe at Pelosi and her investment-flipping husband, Paul Pelosi.

Pelosi famously pushed back against any stock trading prohibitions during the 117th Congress — “We’re a free market economy.” she declared in December 2021 — but later tasked colleagues with sorting it out amongst themselves.

Pelosi’s office did not immediately respond to Insider’s request for comment about the latest political jab.

Donald Sherman, chief counsel at government watchdog organization Citizens for Responsibility and Ethics in Washington, chided Hawley for the cheap shot.

“Way to undermine an important issue with political stupidity,” Sherman wrote online.

Hawley’s proposal, which is one of the least stringent put forth since Insider’s Conflicted Congress investigation revealed rampant STOCK Act violations on Capitol Hill with no significant consequences, would block congressional members and their spouses from owning or trading individual stocks while in office.

Meanwhile, Democratic Rep. Abigail Spanberger of Virginia and Republican Rep. Chip Roy of Texas have reintroduced a more comprehensive stock trading ban bill (H.R. 345) that’s already attracted nearly four dozen co-sponsors from both parties.

Their bipartisan TRUST in Congress Act — which would require congressional members, their spouses, and any dependent children to relinquish control of their finances by transferring their assets to a qualified blind trust — was a front-runner in last session’s push to bolster ethical governing.

That effort crumbled last December after Democratic leaders in both chambers failed to reach consensus on a substantive fix.

Hawley managed to work in a different type of dig against Pelosi a few months earlier, telling Insider that he was mostly fine with aging political leaders but that “I’d love to see Speaker Pelosi move on.”

Hawley’s sniping in that case came in response to Insider’s “Red, White, and Gray” project, which explores the costs, benefits, and dangers of life in a democracy helmed by those of advanced age.