The Future of Crude Oil – CRUDE OIL: POWERFUL & INDISPENSABLE

The Future of Crude Oil – CRUDE OIL: POWERFUL & INDISPENSABLE

Crude oil will be an an indispensable raw material for years to come – mainly for the chemical industry, since it’s too precious to be consumed for heating or as fuel.

Smartphones, computers, cosmetics, furniture and even cardiac valves – Crude oil is omnipresent and indispensable in the modern world.

The immense global economic growth in recent decades would not have been possible without crude oil. It was and continues to be the fuel for progress and prosperity. The rate of global consumption is currently around 90 million barrels per day. And the age of oil is not even close to coming to an end. But in times of climate change, this valuable resource must be used wisely. Instead of burning it in the boiler room or power plants, it should be used where it has no alternatives: In the chemical industry, for example, crude oil is an indispensable raw material. While we know that oil reserves are finite, they can be developed increasingly effectively thanks to technical innovations. As a result, it will be possible to produce crude oil economically for decades to come.

CRUDE OIL WILL BE NEEDED AS AN ENERGY SOURCE FOR A LONG TIME TO COME

To halt climate change, energy supply must be switched in the long term to renewable energies. However, they will not be able to meet demand for decades to come. In the electricity and heating market, climate-friendly natural gas can fill the gap. But there are still applications where only crude oil can supply the required energy. In the transport sector, for example, oil will remain the most important energy source in the long term, especially for heavy transport where large loads have to be carried over long distances. Only powerful, oil-based fuels with a high range can accomplish that, such as diesel, gasoline, kerosene, and heavy oil. Although work is underway on alternatives with lower CO2 emissions, the much-discussed electromobility, in particular, will soon reach its limits. The supply networks would be unable to handle the huge amounts of additional power needed to electrify transport. Oil on the other hand is flexible to transport: in pipelines, by rail and road, or by ship.

CRUDE OIL IS THE FOUNDATION OF EVERYDAY LIFE

Crude oil is mainly used as a fuel and combustible, but is also indispensable as a chemical raw material. It is the foundation of modern life and in virtually every product around us – from smartphones and vehicle parts to wind turbines. Almost 90 per cent of chemical products contain oil as a raw material, most of all plastics. Polyethylene, for example, is the basis for mobile phone casings, cling wrap and beverage bottles. Transparent polycarbonate is used, for example, to make CDs, DVDs and Blu-ray discs. But oil is not just in plastic: In the production of aspirin and other medicines, cosmetics, fertilizers, paints and varnishes, crude oil is a raw material for which there is no suitable alternative. The less oil is burned to generate heat and power, the more is available for the production of important materials and substances. After all, only 6 to 7 per cent of global oil production is currently used for the chemical industry.

OIL RESERVES ARE FAR FROM DEPLETED

The oil reserves deep below the earth’s surface are finite. Nevertheless, the volume of proven reserves that are considered exploitable continues to increase. Estimated at 683 billion barrels in 1980, they are estimated today at 1,700 billion barrels. There are various reasons for this. For example, as exploration methods continue to improve, more reservoirs will be discovered. In addition, production costs are reduced thanks to innovative technologies. As a result, reservoirs can be developed that would previously have been uneconomical, including smaller and unconventional reservoirs. Another reason is increasingly efficient exploitation. For example, Wintershall Dea uses special techniques like steam flooding to improve the oil recovery rate from reservoirs. With all these improvements, reserve life is not expected to decline for the foreseeable future. Accordingly, an end to economical oil production is still a long way off. source

CRUDE OIL: Feedstocks for the Chemical Industry

Petroleum provides transportation fuel, is a part of many chemicals and medicines, and is used to make crucial items such as heart valves, contact lenses, and bandages. Oil reserves attract outside investment and are important for improving countries’ overall economy.

A Dark Cloud Is Looming Over Chemical Stocks

- A series of profit warnings from chemical companies in June, citing weak demand and tough pricing conditions, raises concerns about potential implications for the broader industrial and cyclical complex.

- As China’s economic revival shows signs of stalling, economists from major institutions, including Goldman Sachs, HSBC, Citi, and Nomura, have revised their GDP growth forecasts lower for 2023, causing uncertainty for globally linked earnings prospects.

- Troubles have also expanded into the packaging sector with profit warnings issued, and there is skepticism about the possibility of a soft economic landing without significant impact on profits, labor, or credit, especially considering the ongoing monetary tightening.

Warnings from the chemical sector on the outlook for earnings are piling up — just as worrying signs about global demand and economic growth begin to multiply across the board.

June has proved a bad month for chemical producers, with four European companies warning about their profit outlook for the rest of the year. This week, Lanxess joined Croda, K+S and Victrex in preparing investors for the impact of weak demand, tougher pricing, or destocking by customers. In the US, Cabot blamed softer global demand as it ditched its full-year forecast.

Whether the worsening outlook for chemicals is a warning for the broader industrial or cyclical complex isn’t yet clear. But without substantial stimulus in China or signs that demand is picking up, caution could be warranted — especially at a time when optimistic investors have pushed their positioning in stocks back to elevated levels.

Industrial shares are usually closely correlated with chemicals and account for nearly 14% of the Stoxx 600, the largest sector weight in the European benchmark after health care. More broadly, economically driven cyclicals are about two-thirds of the market. Their earnings prospects are heavily linked to global growth, which has been driven by China for the past few years. But the Asian giant’s revival is faltering. In the past week, economists at Goldman Sachs, HSBC, Citi and Nomura are among those to have revised their China GDP growth forecasts lower for 2023, doubting that stimulus from Beijing could turn the tide.

“Expectations have been too high about what China will be able to do on stimulus, as the Chinese government is more constrained compared to previous cycles relative to kick-starting the economy through just cutting interest rates or lowering reserve requirements for banks,” says Peter Garnry, head of equity strategy at Saxo Bank A/S.

Valuations remain a concern. The latest drop in chemical stocks has taken the premium on the sector’s price-to-earnings ratio over the broader European market back to its 10-year average of about 19%, after peaking at 40% last year. Industrials are still trading near a similar record premium of 40%, double the 10-year average.

In another worrying sign, troubles are expanding into the packaging sector, with Mayr-Melnhof Karton becoming the latest European company from the sector to issue a profit warning. This follows other paper and pulp sector warnings from companies including Billerud AB, UPM-Kymmene, and Stora Enso.

European cyclicals have brushed off weak macro-economic forecasts and surveys, thanks to hard data like GDP figures, which have held up well so far this year. Hopes of a soft landing and a peak in yields have supported stocks, while receding inflation has also helped.

Still, other overall macro-economic readings give a less positive picture. Manufacturing PMIs remain in the doldrums, in sharp contrast with the expansion in services data this year. A debate rages over how this gap will close, with UBS strategists Gerry Fowler and Sutanya Chedda contending that services activity will be dragged lower.

“European services new orders PMIs reversed quite sharply in May,” the UBS strategist say. “If this is a sign of emerging weakness in services demand, it could lead to more sector correlation and equity downside.”

“The main disconnect that the market will need to grapple with revolves around the hopes of a soft landing, without much pain to profits, labor or credit, but at the same time the expectation that inflation will come down quickly,” says Vincent Rennella, Silex Investment Managers’ head of equity strategy, who is keeping his defensive stock allocation. “How can the consensus think that the worst of pressures is behind us, when the impact of monetary tightening historically worked with a lag, especially with a Fed that has not even stopped hiking?” source

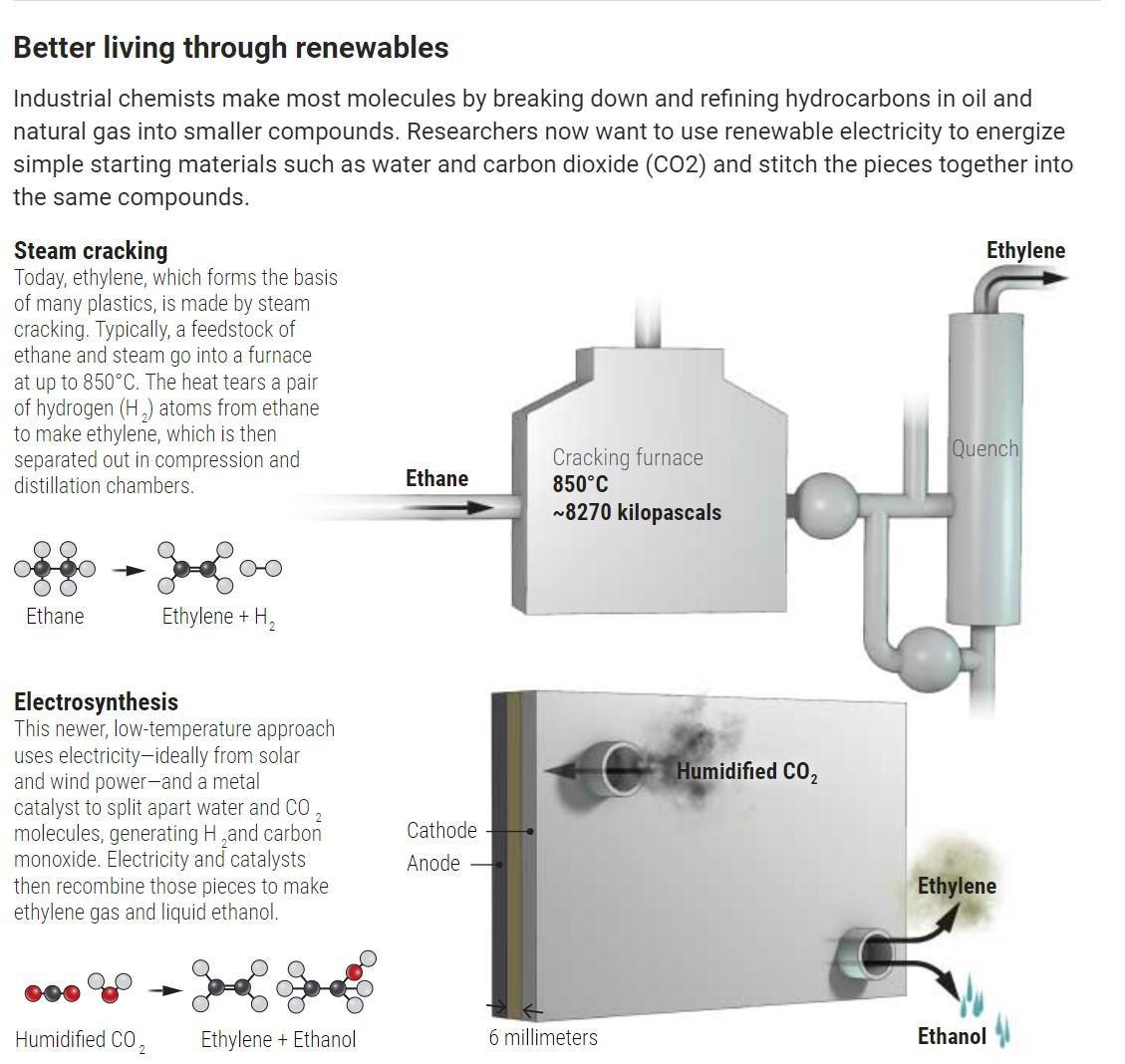

Can the world make the chemicals it needs without oil?

With solar and wind booming, the chemical industry dabbles with forgoing petroleum as its source

Black, gooey, greasy oil is the starting material for more than just transportation fuel. It’s also the source of dozens of petrochemicals that companies transform into versatile and valued materials for modern life: gleaming paints, tough and moldable plastics, pesticides, and detergents. Industrial processes produce something like beauty out of the ooze. By breaking the hydrocarbons in oil and natural gas into simpler compounds and then assembling those building blocks, scientists long ago learned to construct molecules of exquisite complexity.

Fossil fuels aren’t just the feedstock for those reactions; they also provide the heat and pressure that drive them. As a result, industrial chemistry’s use of petroleum accounts for 14% of all greenhouse gas emissions. Now, growing numbers of scientists and, more important, companies think the same final compounds could be made by harnessing renewable energy instead of digging up and rearranging hydrocarbons and spewing waste carbon dioxide (CO2) into the air. First, renewable electricity would split abundant molecules such as CO2, water, oxygen (O2), and nitrogen into reactive fragments. Then, more renewable electricity would help stitch those chemical pieces together to create the products that modern society relies on and is unlikely to give up.

“This is very much a topic at the forefront right now,” says Daniel Kammen, a physicist at the University of California, Berkeley.

Chemists in academia, at startups, and even at industrial giants are testing processes—even prototype plants—that use solar and wind energy, plus air and water, as feedstocks. “We’re turning electrons into chemicals,” says Nicholas Flanders, CEO of one contender, a startup called Opus 12. The company, located in a low-slung office park in Berkeley, has designed a washing machine–size device that uses electricity to convert water and CO2 from the air into fuels and other molecules, with no need for oil. At the other end of the commercial scale is Siemens, the manufacturing conglomerate based in Munich, Germany. That company is selling large-scale electrolyzers that use electricity to split water into O2 and hydrogen (H2), which can serve as a fuel or chemical feedstock. Even petroleum companies such as Shell and Chevron are looking for ways to turn renewable power into fuels.

Changing the lifeblood of industrial chemistry from fossil fuels to renewable electricity “will not happen in 1 to 2 years,” says Maximilian Fleischer, chief expert in energy technology at Siemens. Renewable energy is still too scarce and intermittent for now. However, he adds, “It’s a general trend that is accepted by everybody” in the chemical industry.

A SHARP RISE in supplies of solar, wind, and other forms of renewable electricity lies behind the trend. In 2018, the world surpassed 1 terawatt (TW) of installed solar and wind capacity. The second TW is expected by mid-2023, at just half the cost of the first, and the pace is likely to accelerate. One recent analysis suggests lower prices for renewable generation could prompt the development of 30 to 70 TW of solar energy capacity alone by 2050, enough to cover a majority of global energy needs. “In the near future there will be a bunch of renewable electrons around,” says Edward Sargent, a chemist at the University of Toronto in Canada. “And a lot of them are going to be cheap.” According to the National Renewable Energy Laboratory, the cost of utility-scale solar power should drop by 50% by 2050 and the cost of wind power by 30%.

That surge in renewables has already led to brief periods when electricity supplies exceed demand, such as midday in sunny Southern California. The result is dramatic price drops. At times, utilities even pay customers to take electricity so that excess supply doesn’t melt transmission lines. “This gives us an opportunity to make something valuable with these electrons,” Sargent says.

Rise and fall

One potential role for those electrons is to displace the fossil fuels that now provide the heat needed to drive industrial reactions. In the 24 May issue of Science, Sebastian Wismann and Ib Chorkendorff of the Technical University of Denmark in Kongens Lyngby and colleagues reported redesigning a conventional fossil fuel–powered reactor that makes H2 from methane and steam to run on electricity. In their new reactor, electricity flowing through an iron alloy tube encounters resistance, pushing temperatures as high as 800°C. The heat causes methane and steam flowing though the tube to react, stripping H2 from methane more efficiently than traditional methods and potentially offering both cost savings and reduced climate impact.

But even if the heat comes from electricity, reactions such as those that generate fuel from methane still emit waste CO2. Chemists want to go further, harnessing electrons not just as a source of heat, but as a direct input to the reactions. Industrial chemists already use electricity to smelt aluminum from bauxite ore and generate chlorine from salt—electron-adding reactions for which electrically driven chemistry is ideally suited. But as with H2, most commodity chemicals are made from fossil fuels, transformed with heat and pressure generated by more fossil fuels.

Giving up those fuels doesn’t involve chemical magic. Key industrial chemicals such as carbon monoxide (CO) and ethylene can already be made by adding electrons to abundant starting materials such as CO2 and water, if efficiency is no object. The trick is to do so economically.

That process requires a cheap source of renewable electricity. But according to an analysis in the 26 April issue of Science led by Sargent and Thomas Jaramillo, a chemical engineer at Stanford University in Palo Alto, California, that’s not the only prerequisite. Sargent, Jaramillo, and colleagues compared the costs of making a variety of simple industrial compounds with fossil fuels or renewable electricity. They found that electrosynthesis would be competitive for producing chemical staples such as CO, H2, ethanol, and ethylene if electricity cost 4 cents per kilowatt hour (kWh) or less—and if the conversion of electrical energy to energy stored in chemical bonds was at least 60% efficient.

If electricity’s cost fell further, more compounds would be within reach. In a May 2018 analysis in Joule, Sargent and colleagues found that under stricter market assumptions, including an electricity price of 2 cents/kWh, synthesizing formic acid, ethylene glycol, and propanol would all be feasible. “This gives us a clear set of targets,” says chemist Phil De Luna, a Sargent collaborator at National Research Council Canada in Toronto.

Sargent’s papers are “right on the mark,” says Harry Gray, a chemist at the California Institute of Technology (Caltech) in Pasadena, who has analyzed what’s needed to displace fossil fuels with electrosynthesis. Of making commodities by electrosynthesis, he says, “I think we’ll be there within 10 years.”

the importance of crude oil for our chemistry and chemical needs

Kammen notes that several utility-scale solar and wind projects already meet one benchmark, delivering power at or below 4 cents/kWh, and the cost of renewables continues to decline. But reaching 60% conversion efficiency of electrical to chemical energy is a bigger challenge, and that’s where researchers are focusing their efforts.

The simplest processes, those that make H2 and CO, are already reaching that second benchmark. According to Fleischer, commercial electrolyzers from Siemens and other companies already do better than 60% efficiency in splitting water to produce H2. Siemens uses an established technology called proton-exchange membrane (PEM) electrolyzers, which apply a voltage between two electrodes, one on each side of a polymer membrane. The voltage splits water molecules at a catalyst-coated anode into O2, hydrogen ions, and electrons. The membrane only allows hydrogen ions to pass to the other catalyst-coated electrode, the cathode, where they meet up with electrons to generate H2 gas. The cost of the H2 produced has fallen dramatically in recent years as the size of electrolyzers has increased to industrial scale. Still, Bill Tumas, an associate lab director at the National Renewable Energy Laboratory in Golden, Colorado, noted last month at a meeting of the American Chemical Society that the cost of the electrolyzers, as well as their component electrode materials and catalysts, needs to drop further to generate H2 at a price competitive with massive thermal plants that break apart methane.

Opus 12 and other companies also rely on PEM electrolyzers but add a supplementary catalyst to the cathode to split piped-in CO2 into CO and O2. The CO can be captured and sold for use in chemical manufacturing. Or it can be combined with hydrogen ions and electrons generated at the anode to construct a range of other building blocks for industrial chemistry, including gases such as ethylene—the raw material for certain plastics—and liquids such as ethanol and methanol. According to Etosha Cave, Opus 12’s chief scientific officer, the company has already produced 16 commodity chemicals. And it is working to scale up its reactors over the next few years to process tons of CO2 per day, most likely captured from flue gas from power plants and other industrial sources.

Crude oil to chemicals – Supporting the energy transition

The growing supply of renewable energy has some chemists thinking about ways to generate carbon-neutral fuels. Last month, in Dresden, Germany, a company called Sunfire completed a test run of a high-temperature electrolysis reactor, known as a solid-oxide fuel cell, that promises even higher efficiency than PEM electrolyzers. The reactor is at the heart of a four-stage test plant that generates fuel from water, CO2, and electricity. The first stage of the boxcar-size plant separates CO2 from air and then feeds the CO2 to Sunfire’s fuel cell. It works a bit differently from its PEM counterparts: It uses electricity to split both water and CO2 at the cathode, generating a mix of CO, H2, and negatively charged oxygen atoms, or oxide ions. Those ions travel through an oxygen-permeable solid membrane to the anode, where they give up electrons and combine to produce O2. The mix of CO and H2, known as synthesis gas, then moves to a third reactor, which assembles them into more complex hydrocarbons. At the fourth stage, those hydrocarbons are combined with more H2 and refashioned into the mix of hydrocarbons in gasoline, diesel, and jet fuel. Because the plant works at high temperatures, the water- and CO2-splitting reactions convert electrical energy to chemical bonds at nearly 80% efficiency, the company says.

Sunfire’s test plant now makes about 10 liters of fuel per day. The company is already scaling up the technology and plans to open its first commercial plant, in Norway, next year. The setup will be part of a larger plant that will use 20 megawatts of hydropower to produce 8000 tons of transportation fuel per year, enough to supply 13,000 cars. Its method will avoid producing 28,600 tons of CO2 annually from fossil fuels.

Another advance could also boost efficiency: using industrial waste as the source of electrons needed to split off CO from CO2. Oxygen’s formation at the anode, producing electrons, is normally so sluggish that 90% of the overall process’s electrical energy goes to this reaction. In the 22 April issue of Nature Energy, chemist Paul Kenis of the University of Illinois in Urbana and colleagues reported spiking the anode with glycerol—a clear, viscous liquid that’s a byproduct of biodiesel production—which gives up its electrons more readily. By doing so, the technique could reduce the energy requirement for splitting CO2 by 53%. And as a bonus, when glycerol loses electrons, it produces a combination of formic acid and lactic acid, two common industrial compounds used as preservatives and in cleaning products and cosmetics. “You take a waste and turn it into something of value,” Kenis says.

THOUGH SIMPLE INDUSTRIAL chemicals may be poised for greening, directly synthesizing most complex hydrocarbons with electricity remains too inefficient and costly. Even making compounds with just two carbons, such as ethylene and ethanol, typically captures only about 35% of the input of electrical energy in the final compound. With three-carbon compounds and beyond, the efficiency can drop below 10%. The problems are twofold: First, every time new bonds are forged, some energy is lost. And generating more-complex hydrocarbons inevitably means making more side products. That outcome forces producers to separate their desired compound, at extra cost.

But innovations are starting to help there, too, including better catalysts. In the 21 August online issue of Joule, for example, Sargent and his colleagues report creating a device that uses a membrane coated with a copper catalyst to convert CO2 and steam to a mix of two-carbon compounds, including ethylene and ethanol, with 80% efficiency. They achieved that efficiency by pressing one electrode directly onto the membrane, thereby eliminating a fluid-filled gap that was sapping energy and was causing the device to break down quickly.

One class of complex molecules that could prove easier to make with electricity is carbon nanotubes. Those long, hollow, strawlike molecules—prized for their strength and electronic capabilities—are commonly made through chemical vapor deposition: In a heated quartz tube, cobalt and iron catalysts strip away carbon atoms from pumped-in acetylene gas and add them to growing nanotubes that take seed on the metal particles. That process is energy intensive and expensive, typically costing about $100,000 to produce 1 ton of nanotubes. But in 2015 in Nano Letters, Stuart Licht, a chemist at George Washington University in Washington, D.C., and colleagues reported an electrolysis approach calculated to cost one-100th as much.

Licht’s setup starts with molten lithium carbonate spiked with metal catalysts. An electric current strips carbon atoms from the lithium carbonate and adds heat that sustains the reaction. The catalysts pick up the carbons and insert them into growing nanotubes. Bubbling CO2 into the mix then regenerates the lithium carbonate. The process is 97.5% efficient. Because it uses waste CO2, Licht notes it is carbon negative: Making each ton of carbon nanotubes uses 4 tons of CO2.

The nanotubes can then be mixed into cement to create a high-strength composite that sequesters the carbon, keeping it from oxidizing and returning to the atmosphere. The tubes can also be mixed with metals such as aluminum, titanium, and stainless steel to strengthen them. C2CNT, a company Licht formed to commercialize the technology, is one of 10 finalists for the Carbon XPrize, which will award $20 million for successful technologies for turning CO2 into products.

HOW QUICKLY THE VAST chemical plants sprawling over the world’s industrial zones will shift from fossil fuels to green power is a matter of debate. Nate Lewis, a chemical engineer at Caltech, says the transition will be slow. One major hurdle, he notes, is that renewables are intermittent, meaning chemical plants relying on them will be inefficient. Economists capture the idea with a measure called the capacity factor, a ratio of a plant’s output over time compared with what’s theoretically possible. Fossil fuel–powered chemical plants can run around the clock, although downtime for maintenance and for other issues typically reduces their capacity factor to about 60%. But the inputs to a plant powered by renewables themselves have low capacity factors: Wind and hydropower typically come in just under 50%, and solar drops to below 25% because of nighttime and cloudy days. “Your full capacity is only being used for a few hours a day,” says Harry Atwater, a chemist at Caltech and head of the Joint Center for Artificial Photosynthesis, a solar fuel collaboration among Caltech, Lawrence Berkeley National Laboratory, and other institutions. The upshot, Lewis notes, is that any plant powered by renewables would take longer to make a profit, making investors reluctant to back such projects.

Plants driven by renewables could stay online longer if they drew on multiple power sources or had a steadier power supply thanks to batteries or another form of energy storage, Kammen notes. But those solutions can add cost, Lewis says. “We’re still a long way away” from generating most commodity chemicals profitably from renewables. Producing enough renewable electricity to remake the chemical industry is also a challenge. In an analysis in the 4 June issue of the Proceedings of the National Academy of Sciences, for example, researchers concluded that running the global chemical industry on renewables would require more than 18 petawatt hours of electricity, or 18,000 terawatt hours, every year. That’s 55% of the total global electricity production expected from all sources in 2030.

Perhaps the most likely outlook for industrial chemistry is a gradual greening. Until chemists can find catalysts able to make complex hydrocarbons with high efficiency, companies may use renewable electricity to produce simple molecules such as H2 and CO and then fall back on fossil fuels to drive the reactions to stitch those together into more complex hydrocarbons.

But as chemists develop new reactors and find ever-more-charmed combinations of catalysts—and as renewable energy continues to surge—the plants that churn out chemical staples will inevitably become more like the green variety, fully sustained by sun, air, and water. source